Redefining our 2024 energy budget -Why do I need to change my way of working now?

There are three important reasons why this evolution has taken place over the last two years:

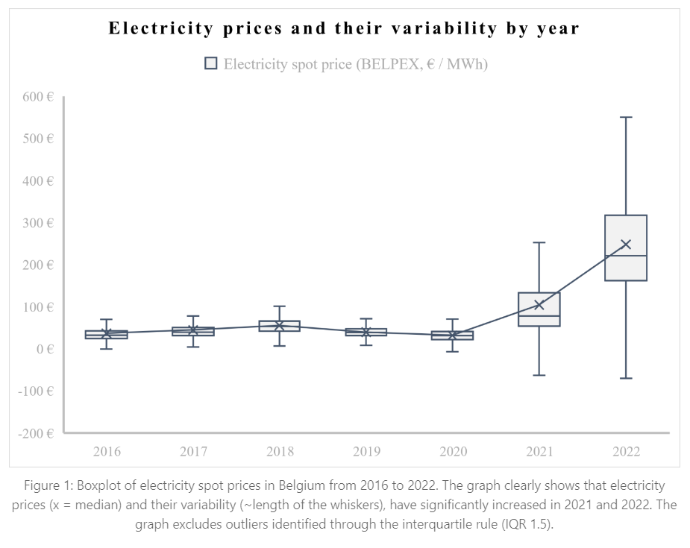

- As you may be aware (If you were not living under a rock), geo-political developments have exerted a significant influence on the energy market, resulting in heightened price volatility. However, on the long run, this volatility is likely to persist in the future due to the increasing adoption of renewable energy production methods. Renewable energy production is inherently volatile. In the ensuing chart, this inherent volatility becomes evident.

For example the average day-ahead spread in 2023 is so far 84% of average day-ahead price in the Belgian market. Meaning that if you have an average day-ahead price of 100 €/MWh prices on that day will actually fluctuate between 58 €/MWh and 142 €/MWh. - Electrification is happening right now and it is strongly pushed by many political agenda’s, especially on European level as an enabler for the delivery of the Green Deal (see: https://electrificationstrategy.eu/). Therefore many companies have already invested or are looking to invest in the infrastructural necessities to incorporate this important change. This implies a more complex energy setup, both in terms of production (i.e. solar panels, PPAs*, …), consumption (electric vehicles and trucks, energy efficiency initiatives) and storage (battery electric storage systems, buffers, …).

- There is an increased demand for transparency, induced by the (inter)national reporting standards, laws and also requests from customers and other stakeholders. It results, among others, for example in 24/7 renewable energy matching. Where at anytime the energy consumption is matched with the renewable energy production. An example here is Google that provides transparency around this on his website: https://sustainability.google/progress/energy/.

Since the topic has risen so quickly and new technologies are entering the market constantly, it can be hard to keep an overview and make fact-based decisions. So, where should you begin when embarking on the journey to establish an energy budget for the upcoming year?

*Power Purchase Agreement, which offers the possibility to virtually buy green energy produced by sustainable production projects such as off-shore wind turbines.

Set your goals & objectives

The energy transition today is at the table of almost all Board room discussions. It is triggered by questions around cost (€), around energy sourcing (kW) and around sustainability targets (CO2). It is a must in light of the achievements of the Paris Agreements, and also to remain relevant in the commercial market and recruitment.

Before diving into the actual budgeting exercise it is important to align your energy goals & objectives with your business and sustainability strategy.

- Energy cost reduction: In today's market, the energy cost takes a more important share of operational costs than before 2022. The combination of PPAs, hedging strategies, and dynamic market pricing presents opportunities to lower energy expenses.

- Energy cost stability (and predictability): Many businesses are inclined to pay a premium for the assurance of stable and predictable energy costs in the upcoming quarter or year. Certain energy contracts allow for the purchase of energy in the futures market, with options ranging from monthly and quarterly to yearly terms. PPAs and investments in renewable energy can help stabilize costs as well.

- Emission Reduction: Lowering (carbon) emission is becoming a strategic driver for many companies, and it implies certain choices in terms of energy usage and sourcing. Diverse strategies can be employed to achieve emission reduction goals. Enhancing energy efficiency, installing local renewable production, electrifying specific processes, buying Guarantees of Origin, and engaging in green electricity contracts directly with renewable energy providers through PPAs agreements are all effective methods for accomplishing these objectives.

Energy cost objectives for next year’s budget could include investments to achieve reduction (cost and emission) on the long run.

Use data for fact-based decision making

With the energy market's ever-changing dynamics and the rise of intermittent renewable energy generation, harnessing granular data is essential for informed analysis. Typically, energy meters consolidate data on consumption, production, and injection at an hourly or 15-minute interval. Leverage this data to your advantage!

In order to make an informed decision about your energy budget, you can take the following steps:

- Understand your current consumption and production profile, linked to the evolution of the market prices. It is important to have to most detail possible, hence the closed to the energy consumer or producer. Making this visual will already give a lot of insights on what is possible in terms of energy efficiency (for example, changing lightning to LED, or heating) and potential mismatches between your peak demand/production and the energy market prices.

- Forecast your consumption based on historic data (15 min.). By incorporating this input alongside historical consumption data, it becomes possible to create a precise forecast of your future energy consumption, which is of great importance. Use therefore input from:

- Operations

- What is the projected production schedule for the coming year?

- How is it connected with your energy consumption?

- Fleet: Are you in the process of installing electric chargers and transitioning your fleet to electric vehicles?

- Facility

- Have you implemented any energy efficiency measures or do you have plans to implement them in the upcoming year?

- Are there any plans to replace gas boilers with heat pumps

- Forecast your local production of energy as well as any off-site contracted production (i.e. through a PPA or energy sharing agreements).Renewable energy forecasts can be based on historic data from your production site, but also from online data sources (e.g. PVGis or Renewables.ninja).

- Derive the right insights from your consumption and production forecasts:

- When does your organisation primarily draw energy from the grid—during peak consumption hours (7-10 AM or 3-7 PM) or more during off-peak times? Depending on your usage pattern, either a fixed or time-variant contract could offer greater benefits.

For example: our software enabled one of our customers, a biotech company, to switch to a dynamic contract, bringing them 10% yearly energy cost savings. - Do you generate a substantial surplus of energy that's fed back into the grid? Evaluate and benchmark your injection contract, or if feasible, steer your installation to boost energy consumption during periods of renewable energy generation.

- When does your organisation primarily draw energy from the grid—during peak consumption hours (7-10 AM or 3-7 PM) or more during off-peak times? Depending on your usage pattern, either a fixed or time-variant contract could offer greater benefits.

Leverage these forecasts and insights, both from a purely data perspective and from a business (client/customer) perspective, to budget your energy costs for the upcoming year. Ensure that you regularly update these forecasts to:

- Analyse your historical forecast errors diligently to enhance future predictions, ensuring the reliability of your data, as the credibility of subsequent insights and outcomes hinges upon it. For example, by optimizing the entire supply chain (shifting production, logistics,…) some initial gains in energy are possible and have a direct ROI.

- Re-evaluate your hedging strategy, considering both internal needs and external market conditions.

- Align your contract mix with your predetermined objectives.

Bringing key stakeholders - facility and operational managers, finance and energy experts - along is paramount in such an exercise. They possess valuable insights into different aspects of the organization's energy consumption, production and storage that will affect your analysis.

Testimonial

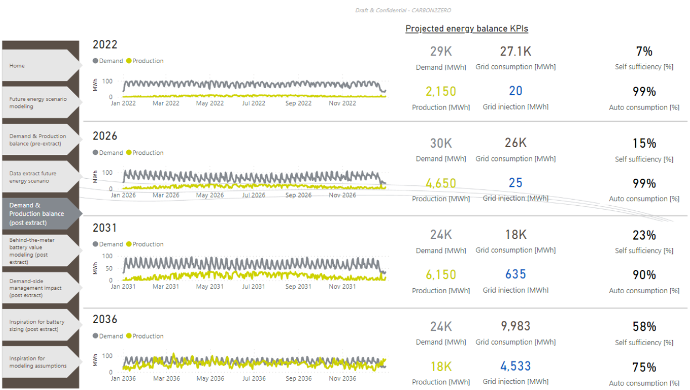

In a recent project, ngage consulting & Companion.energy joined forces to enhance the energy mix for a large Belgian aviation manufacturing company. Despite their adoption of hedging strategies, the company faced an astonishing 400% surge in their electricity and gas expenses compared to their baseline costs. This led them to reach out to our team, seeking guidance on how to refine their current energy management approach. The deliverables were :

- A customized tool that was capable of forecasting the company's future energy consumption and production. This tool, combined with daily updated energy prices, enabled the performance of risk analysis for future budgeting exercises, enhancing financial planning capabilities.

- A long term energy sourcing plan with a focus on renewables.

- A long term hedging strategy that minimizes market price exposure.

- A business case for the implementation of a storage battery, which yielded a negative outcome.

Other key aspects to consider?

Creating an energy budget is more than just crunching numbers; it's a dynamic process that demands an understanding of diverse factors. Market volatility, regulatory changes, evolving technology, and internal operational dynamics all contribute to the intricate puzzle that is your energy budget. These complexities underscore the necessity of a comprehensive approach, and the following aspects are also to be taken into account.

- Alignment with overall business and sustainability strategy:

- Think about the question or problem you try to solve. As for every capital-intensive aspect of a business, energy budget should be considered as a best practice and directly connected to a organisation’s energy strategy. By aligning the energy budget with strategic objectives, it ensures that resources are wisely allocated. This means that investments in energy-related activities are directed towards efforts that directly contribute to both energy use reduction, emissions chopping and broader business success.

- Think medium to long term (3+ years). Start small (and celebrate 1st successes). Move fast.

- Base your strategy on your risk appetite and the value-at-risk.

- Prioritize in light of your objectives, bearing in mind that energy efficiency is always the first step to consider. Think about isolation, more efficient use of production assets, less driving,… It might seem logical, but we tend to forget and neglect this point when looking at larger investment projects.

- Couple the initiatives to your sustainability roadmap as well (reporting, regulation, …).

- Navigating the complex regulatory landscape:

- Regulatory changes, tariffs, incentives, and compliance requirements can significantly impact energy costs and influence the overall budgeting process. Navigating this complex terrain requires understanding how regulatory changes might impact your energy costs and identifying opportunities to capitalize on incentives that will drive future decisions.

- This also extends beyond purely financial considerations and includes the need to meet non-financial reporting obligations whose directives start to emerge more forcefully.

- Couple the initiatives to your sustainability roadmap as well (reporting, regulation, …

- Culture and Change Management: To define and manage an energy budget, strong business-wide ownership is required. The decisions and implications should be set and shared among the whole organisation. Communicating energy budget goals, sharing progress, recognizing and rewarding positive behaviours will foster the development of a culture of energy responsibility. When stakeholders are actively involved, they develop a sense of ownership and accountability for the outcomes and are more likely to support and advocate for budget decisions and associated initiatives.

- Accelerate the shift through technology solutions supporting the business (energy management systems, field service solutions, client and data platforms, …).

- Consider it cross-departmental within your organisation: procurement, operations, service, sales & marketing, finance, …

- Define how you want to address it: is energy a core competence or not?

- Link the reflection to your day-to-day business/ demand (and offering).

There is unfortunately no “one-size-fits-all” energy solution.

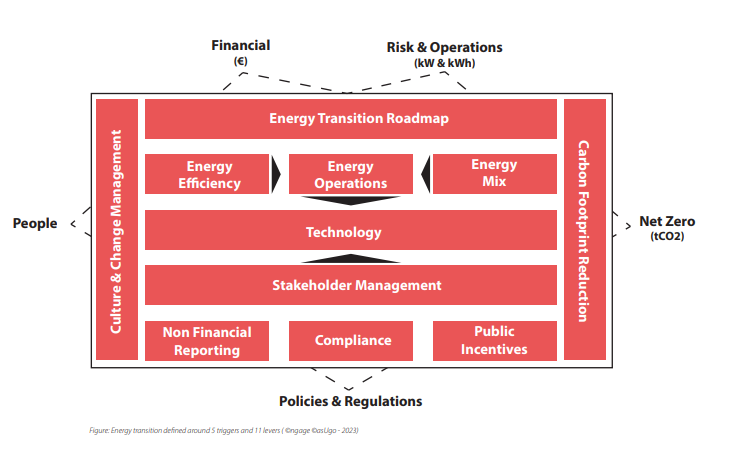

As an overview, we see main underlying business challenges by activating 11 levers of the Energy Transition. Happy to discuss them with you:

ngage consulting and Compagnion.Energy assist companies in the definition of their specific energy management strategy in line with the overall strategic (sustainability) targets and translated in supporting data visualisation tools to facilitate decision making.